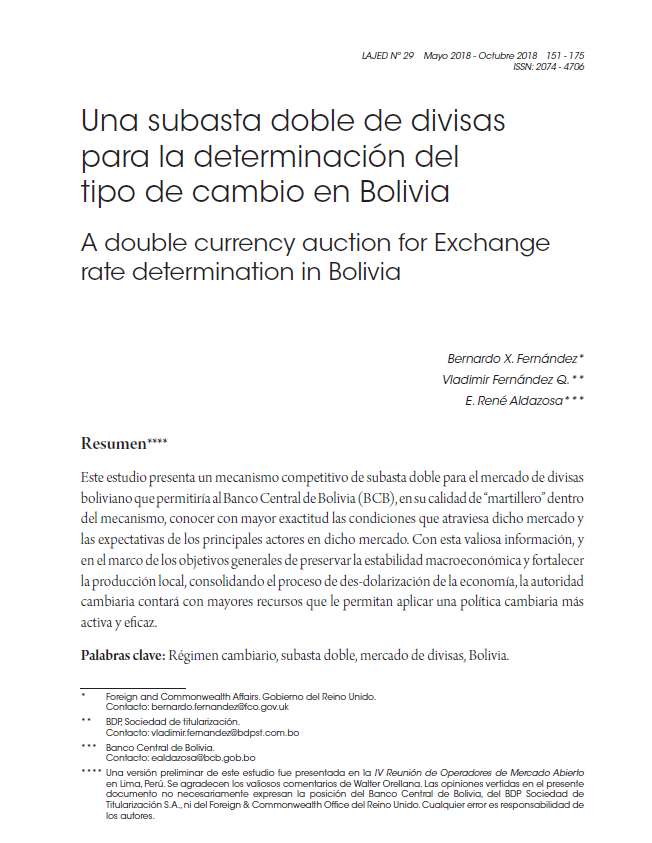

Una subasta doble de divisas para la determinación del tipo de cambio en Bolivia

DOI:

https://doi.org/10.35319/lajed.20182922Palabras clave:

Régimen cambiario, subasta doble, mercado de divisas, BoliviaResumen

Este estudio presenta un mecanismo competitivo de subasta doble para el mercado de divisas boliviano que permitiría al Banco Central de Bolivia (BCB), en su calidad de "martillero" dentro del mecanismo, conocer con mayor exactitud las condiciones que atraviesa dicho mercado y las expectativas de los principales actores en dicho mercado. Con esta valiosa información, y en el marco de los objetivos generales de preservarla estabilidad macroeconómica y fortalecer la producción local, consolidando el proceso de des-dolarización de la economía, la autoridad cambiaria contará con mayores recursos que le permitan aplicar una política cambiaria más activa y eficaz.

Descargas

Citas

Aflouk, N., S. Jeong, J. Mazier y J. Saaudaoui. 2010. “Exchange Rate Misalignments and International Imbalances a FEER Approach for Emerging Countries”. Economie internationale, vol. 124(4). 25-57

Aldcroft, D. y M. Oliver. 1998. Exchange Rate Regimes in the Twentieth Century. Edward Elgar.

Antelo, E. 2000. “La dolarización en Bolivia: evolución reciente y perspectivas futuras”. Análisis económico, vol. 15, pp. 114-138. Unidad de Análisis de Políticas Económicas.

Baillu, J. y J. Murray. 2003. “Exchange Rate Regimes in Emerging Markets”. Bank of Canada Review, Winter 2002-2003.

Bermúdez, C. 2014. “De facto exchange rate regimes and inflation targeting in Latin America: Some empirical evidence from the past decade”. EconoQuantum. 11(1), 31-57.

Broto, C. 2012. “The effectiveness of FOREX intervention in four Latin American countries”. Banco de España. Documento de trabajo N° 1226.

Calvo, G. y C. Reinhart. 2002. “Fear of Floating”. Quarterly Journal of Economics, vol. 117 (May), pp. 379-408.

Celiktemur, C. y D. Szerman. 2012. “Auctions with Random Ending Time”. Discussion Paper. London School of Economics.

Céspedes, A. y J. Cossío. 2015. “Profundización del proceso de remonetización en Bolivia: políticas y resultados”. Revista de análisis, vol. 23, pp. 9-62. Banco Central de Bolivia.

Chakravraty, S., R. Wood y R. Van Ness. 2004. “Decimals and liquidity: a study of the NYSE”. The Journal of Financial Research, 27(1), 75-94.

Chutasripanich N. y J. Yetman. 2015. “Foreign exchange intervention: strategies and effectiveness”. BIS Working Paper N°. 499.

Eaves J. y J. Williams. 2007. “Walrasian Tatonnement Auctions on the Tokyo Grain Exchange”. The Review of Financial Studies, 20(4), 1183- 1218.

Falcao Silva, M. 1999. Modern Exchange- Rate Regimes, Stabilisation Programmes and Coordination of Macroeconomic Policies. Ashgate Publishing Ltd

Fershtman D. y A. Pavan. 2016. “Matching Auctions”. Discussion Paper, Northwestern University.

Fischer, S. 2001. Exchange Rate Regimes: Is the Bipolar View Correct? International Monetary Fund. Disponible en www.imf.org.

Fondo Monetario Internacional. 2016. De Facto Classification of Exchange Rate Regimes and Monetary Policy Framework.

Friedman, D. 1991. “A Simple Testable Model of Double Auction Markets”. Journal of Economic Behavior and Organization, 15(1), 47-70.

---------- 1993. “Double Auction Institution: A Survey”, en D. Friedman y J. Rust (eds.) The Double Auction Market: Institutions, Theories and Evidence. Santa Fe Institute Studies in the Sciences of Complexity.

Frenkel J. 1997. Regional Trading Blocks in the World Economic System. Institute for International Economics. Washington: Institute for International Economics.

Fullbrunn S. y T. Neugebauer. 2009. “Anonymity deters collusion in hard-close auctions: experimental evidence”. New Zealand Economic Papers, 43(2), 131-148.

Gjerstad, S. y J. Dickhaunt. 1995. “Price Formation in Double Auctions”. Games and Economic Behaviour, vol. 22, pp. 1-29.

Gode, D. y S. Sunder. 1993. “Allocative Efficiency of Markets with Zero-intelligence traders: Markets as Partial Substitutes for Individual Rationality”. Journal of Political Economy, 101(1), 119-137.

Goldberg, L. y R. Tenorio. 1995. “Strategic Trading in a Two-sided Foreign Exchange Auction”. Journal of International Economics, vol. 42, pp. 299-326.

Gray, S. 2005. “The Foreign Exchange Auction in Iraq”. Middle East Economic Survey, vol. XLVIII, mayo.

Ishii, S., J. Canales-Kriljenko, R. Guimarães y C. Karacadag. 2006. “Official Foreign Exchange Intervention”. Ocassional Paper. Nº 249. International Monetary Fund. Washington: International Monetary Fund.

Ize, A., N. Saker, F. Morandé y B. Topf. 2005. Enhancing the use of Local Currency and The Flexibility of the Exchange Rate. Washington: International Monetary Fund.

Kaltenbrunner A. y M. Nissanke. 2009. “Why Developing Countries Should Adopt Intermediate Exchange Rate Regimes: Examining Brazil’s Experience”. Development Viewpoint, 29. Center of Development Policy and Research.

Knight, M. 1997. “Central Bank Reforms in the Baltics, Russia and Other Countries of the Former Soviet Union”. Ocassional Paper, Nº 157. Diciembre. Washington: International Monetary Fund.

Levitt, A. 2000. “Securities and Exchange Commission”. Chairman Speech. March 2000.

Li, J y A. Ouyang. 2009. “Currency crises: can high reserves offset vulnerable fundamentals?” Applied Economics, 43(16), 2055-2069.

Mussa, M., P. Masson, A. Swoboda, E. Jadresic, P. Mauro y A. Berg. 2000. “Exchange Rate Regimes in an Increasingly Integrated World Economy”. Ocassional Paper. Nº 193. International Monetary Fund. Washington: International Monetary Fund.

Obstfeld, M., J. Shambaugh y A. Taylor. 2004. “The Trilemma in History: Trade-offs among Exchange Rates, Monetary Policies, and Capital Mobility”. NBER Working Paper. Nº 10396. Cambridge: National Bureau of Economic Research.

Parsons S., M. Marcinkiewicz, J. Niu y S. Phelps. 2006. Everything you wanted to know about double auctions, but were afraid to (bid or) ask. Brooklyn College City University of New York

Summers, L. 2000. “International Financial Crises: Causes, Prevention, and Cures”. American Economic Review, Papers and Proceedings, 90(2), 1-16, May.

Tobal, M. y R. Yslas. 2016. “Two Models of FX Market Interventions: The Cases of Brazil and Mexico”. Banco de Mexico. Working Paper 2016-4.